Senior living (independent living and assisted living combined) occupancy in the second quarter increased for the fourth quarter in a row, a positive sign for sector recovery, the National Investment Center for Seniors Housing & Care said Thursday.

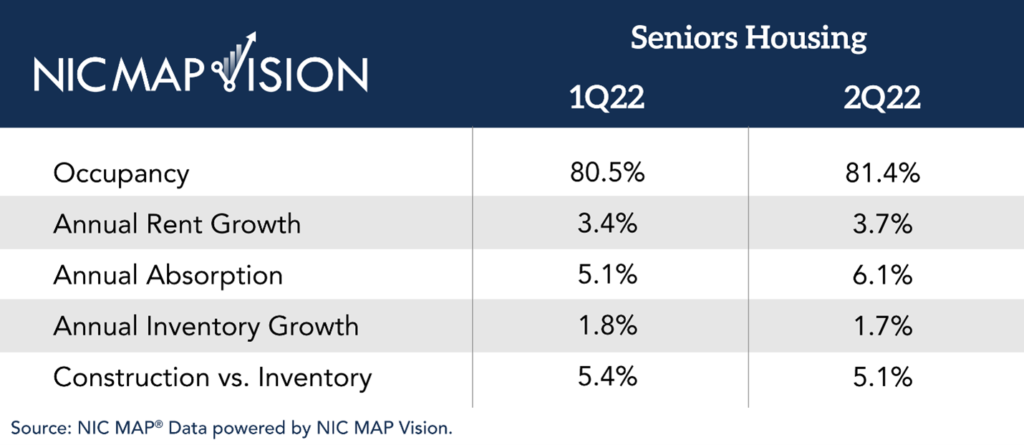

Occupancy increased 0.9 percentage points, from 80.5% in the first quarter to 81.4% in the second quarter, data from the latest NIC MAP Vision report revealed. Occupancy is up 3.4 percentage points compared with a pandemic low of 78% in the second quarter of 2021.

“The sector has not fully recovered from occupancy losses during the height of the pandemic, but the continued upward occupancy trend despite workforce and supply challenges, is a positive sign,” NIC Chief Operating Officer Chuck Harry said in a statement. “Today’s economic challenges could present another hurdle for operators, but we cautiously believe that the upward trend in occupancy will continue because the need for senior housing remains strong.”

Once again, assisted living led the way. Assisted living had the largest quarterly gain, increasing 1.1 percentage points to 78.8% from the first quarter, up from its pandemic low of 74.1% in the second quarter of 2021 but below its 84.7% pre-pandemic occupancy level. The figures are in line with the NIC intra-quarterly snapshot released in May.

Independent living occupancy increased 0.7 percentage points to 83.9% and was up 2.2 percentage points from a pandemic low of 81.7% in the first quarter of 2021. Occupancy in independent living remains below its 89.6% pre-pandemic level.

Annual senior living rental rates also increased across NIC MAP’s 31 primary markets, from 3.4% in the first quarter to 3.7% in the second quarter. Assisted living experienced a 4.6% increase in the second quarter, the largest increase since 2005. Independent living reported a 3% increase.

Demand outweighs supply

Demand continues to outweigh supply, which is driving occupancy upward, NIC said. In fact, quarterly demand was reported at its highest level since NIC MAP Vision began reporting the data in 2005.

Annual inventory growth increased at a slower pace — 1.7% in the second quarter compared with 1.8% in the first quarter — largely due to the slowdown in construction starts in 2020 driven by the pandemic, the group said. Construction starts remained weak in the second quarter, with units under construction at their lowest level since 2015.

“Rising materials prices, high inflation, construction industry labor shortages and the Federal Reserve’s policy change toward higher interest rates are collectively stalling new constructions,” NIC Chief Economist Beth Burnham Mace said in a statement. “This will likely continue the trend of low to moderate levels of new inventory, which should help boost occupancy.”

Where occupancy is highest, lowest

Boston (86.3%), Minneapolis (85.1%) and Portland, OR, (85%) had the highest senior living occupancy rates in the second quarter. Houston (76.1%), Atlanta (77.8%) and Cleveland (78.2%) reported the lowest occupancy rates, according to NIC MAP data.

NIC previously reported that Riverside, CA, was the first of the 31 primary markets to reach its pre-pandemic stabilized occupancy level for senior living.

NIC data also showed that 78% of senior living units vacated during the pandemic have been re-occupied within NIC MAP’s 31 primary metropolitan markets. Ten of those markets have recovered more than half of their pandemic-related occupancy loss.