Scammers hoping to separate older adults from their savings now appear to favor impersonating Social Security employees rather than IRS employees, suggests the Senate Special Committee on Aging’s 2020 “Fraud Book,” released Wednesday at a committee hearing.

For the first year since 2013, when the committee began its fraud hotline and web page, the top scam reported was not the IRS impersonation scam in 2019. Instead, it was the Social Security impersonation scam. The IRS impersonation scam fell to No. 7 on the list.

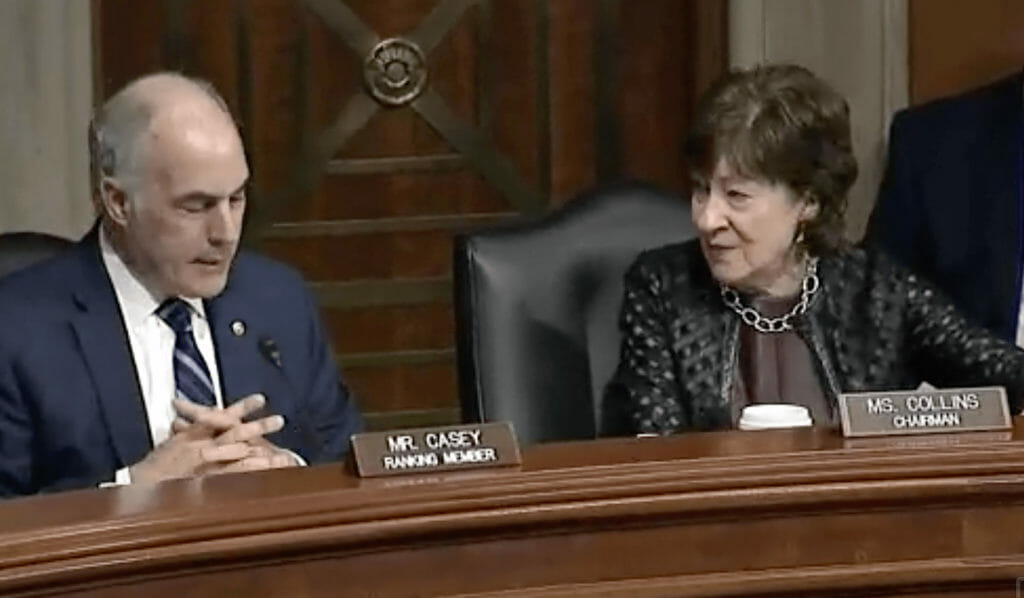

Americans lost $38 million to scammers impersonating Social Security employees in 2019, according to Sen. Susan Collins (R-ME), chairman of the Senate Aging Committee. “I suspect that that’s just the tip of the iceberg, because many seniors who have been affected by this scam are either too embarrassed to report their loss or don’t even know who to turn to,” she said at the hearing.

Collins, Sen. Bob Casey (D-PA), ranking member of the committee, and 11 committee members sent a letter to Health and Human Services Sec. Alex Azar, in his capacity as chair of the Elder Justice Coordinating Council, on Jan. 15 requesting more information about the steps the council has taken to coordinate federal efforts to protect Americans, especially seniors, from the Social Security scam.

“The private sector must also be involved,” Casey said at the hearing. “I have a bill with Sen. Jerry Moran, the Stop Senior Scams Act, which will help banks, wire transfer companies and retailers to train their employees to spot a scam and to stop it before money exchanges hands. The Commerce Committee passed this bill last year without any objection, we are trying to get it through the Senate as well.”

Andrew Saul, Social Security commissioner, and Gail Ennis, inspector general of the Social Security Administration, told committee members what the agency is doing to try to address the problem, including educating employees and the public and collaborating with government agencies to investigate suspected cases of fraud. The SSA OIG posted a form on its website in November to enable members of the public to report suspected cases of the impersonation scam, they said.

“We immediately saw benefits,” Ennis testified in prepared remarks. “We are receiving complaints more timely from the public, with more targeted information, including scammer call-back numbers, caller ID numbers and fraud loss amounts, in a format that is easy to track and analyze for investigative leads.”

Top 10 reported scams of 2019

The Aging Committee’s Fraud Hotline received 1,341 complaints from U.S. residents in 2019. The top 10 scams accounted for more than 70% of them.

The committee accepts calls at (855) 303-9470 and online complaints at https://www.aging.senate.gov/fraud-hotline.

The top 10 types of scams reported in 2019, according to the report:

- Social Security impersonation scam (371 cases)

- Robocalls / unsolicited phone calls (123)

- Sweepstakes scam / Jamaican lottery scam (107)

- Romance scams (99)

- Computer tech support scams (93)

- Grandparent scams (51)

- IRS impersonation scams (34)

- Identity theft (27)

- Debt scams (21)

- Elder financial abuse (18)

The top two states where calls originated were states represented by Collins and Casey — Maine (367 calls) and Pennsylvania (111) — followed by Iowa (110), Florida (83), California (76) and Texas (52).

The book lists the most common types of scams for each state. Additionally, it lists anti-fraud resources.

Watch a recording of Wednesday’s committee hearing and read the prepared remarks of committee leaders and witnesses here.