Demand for senior housing and care continues to increase despite rising COVID-19 cases. That’s according to the latest executive survey from the National Investment Center for Seniors Housing & Care.

Roughly 55% to 60% of senior housing and skilled nursing operators that responded to the Wave 31 survey from July 12 to Aug. 8 reported that the pace of move-ins accelerated in the prior 30 days, the survey found. Similar numbers of respondents reported corresponding occupancy increases.

“Other reasons for the relatively strong pace of move-ins include residents moving through the continuum of care and the success of redoubled marketing efforts,” Peck stated in a blog post. Similar numbers of respondents reported corresponding occupancy increases.

The memory care segment showed the most improvement in occupancy compared with the prior survey, with a 68% increase in occupancy reported. Assisted living operators reported a 62% improvement in occupancy, followed by independent living at 54% and nursing care at 52%.

Organizations generally expect occupancy to return to pre-pandemic levels, with 61% of respondents anticipating occupancy will rebound sometime in 2022.

Vaccine mandates

During the data collection period for the survey several senior living companies — including some of the nation’s largest operators — announced COVID-19 vaccine mandates for employees. Industry groups — AMDA–The Society for Post-Acute and Long-Term Care Medicine, American College of Health Care Administrators, the American Health Care Association / National Center for Senior Living, the American Seniors Housing Association, Argentum and LeadingAge — also have encouraged vaccination or announced their support for vaccine mandates from all healthcare and long-term care employers.

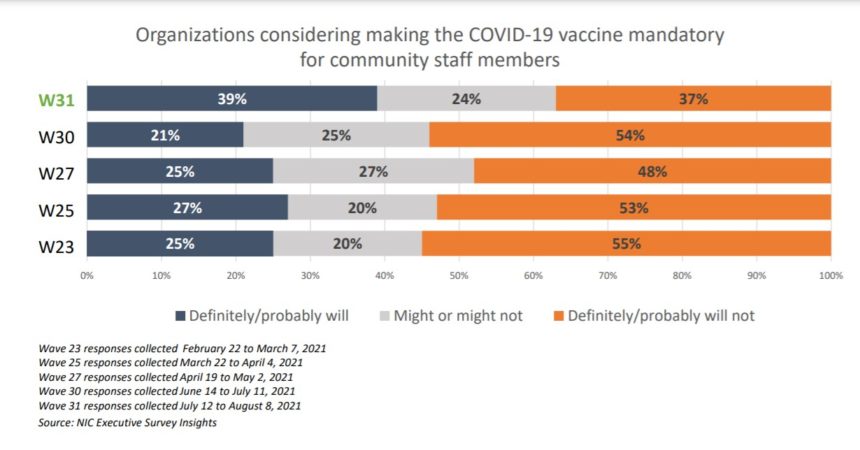

Organizations responding that they will definitely or probably institute a staff vaccine mandate jumped from 21% in the June / July timeframe to 39% in the latest survey, whereas the number of operators saying they will definitely or probably not institute a mandate fell from 54% to 37% in the same timeframe.

Workforce

All of the organizations in the latest survey indicated they were experiencing staffing shortages. Among operators with multiple properties, 80% reported staffing shortages in more than half of their properties — up from 64% in the May / June time period.

The majority of operations indicated that attracting community and caregiving staff (51%) and staff turnover (30%) were their top challenges. All respondents are paying staff overtime — up from 76% in early October 2020. And 84% of operators said they are using agency / temporary staff. About 21% reported hiring staff from other industries, similar to mid-April 2020 survey results.

Roughly 72% reported that increasing wages was the most effective recruitment tool.

Survey respondents included owners and executives of 70 senior living communities and skilled nursing facilities across the country.