Although almost every household with an income of $100,000 or more reports saving for retirement, only half of them (49%) say they believe they will ever be able to retire. That’s according to a survey of 2,000 U.S. adults aged 40 to 65 years old with an annual household income of at least $100,000.

The poll, conducted by financial planning and investment management firm Edelman Financial Engines, found that 74% of survey respondents listed retirement as their top reason for investing. Amid the pandemic, however, a quarter (24%) of pre-retirees, including baby boomers, Gen X and older millennials, have reduced the amount they’re saving for retirement.

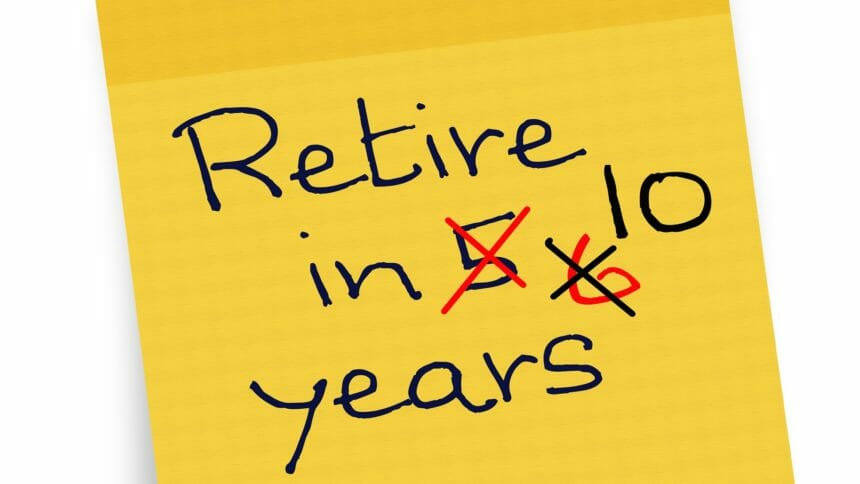

On average, respondents believe they will need to work at least six years longer than they had planned as a result of the pandemic, according to the poll.

“Our survey showed that retirement is by far the most commonly cited reason that Americans invest,” said Ric Edelman, founder of Edelman Financial Engines. “It’s extremely troubling that the pandemic has caused so many to reduce their retirement savings rates, as this will only distance them from their goals.”